Peer-to-peer loans online

At SAVY, borrowers — both individuals and businesses — enjoy fair loan terms, personal support from our team, and flexible solutions tailored to their needs. For investors, it means strong returns with the full benefit of loan interest. We’re here to bring people together and create smarter financial opportunities.

Consumer loan

Mortgage loan

Refinancing

Home renovation

Car

Loan calculator

SAVY – an investment and financing platform, the pioneer of peer-to-peer lending culture in Lithuania. Supervised by the Bank of Lithuania, we ensure sustainable, reliable, and stable growth, proven by multiple “Gazelle” fastest-growing company awards and “TOP Company” business stability certificates.

Delay your first payment by up to 3 months

We understand that when you need to borrow, you may also need more time to start repaying your loan. With SAVY, you can postpone your loan repayment for up to 3 months. This offer applies to all personal loans. Taking advantage of this option is simple.

Save more with loan refinancing

Earning a stable income makes getting a loan neither difficult nor time-consuming. But are you sure you got your loan on the best terms? Every third of our clients refinances their existing loans with SAVY for several important reasons.

Loans up to 12 months at lower rates

Business decisions don’t wait. If you need funding fast — we get it. Right now, we’re offering business loans for up to 12 months at a lower cost, with annual interest rates starting from 8%. Submit your application and documents today, and receive an offer the same or the next business day. Simple. Clear. No delays.

For investors

371

Interest 13%

Reitingas B2

Loan amount 30000 €

Term 70 months

Loan purpose Consumption

Įsipareigojimų ir pajamų santykis 35.98%

Miestas Vilnius

Loan No. 964924

0

Interest 9%

Reitingas 0

Loan amount 55000 €

Term 120 months

Loan purpose Refinancing

Užtikrintumo priemonės Nėra

LTV 36.67% (max 36%)

Loan No. 964706

Chess piece with benefits

The SAVY Loyalty Program is a unique opportunity for SAVY investors to enjoy additional benefits based on the size of their investment portfolio. The larger your active loan portfolio on the platform, the more valuable privileges you receive.

Refer a friend and you both earn up to €1,000

The best things come from sharing! Refer a friend to invest with SAVY and you’ll both receive 1% of your friend’s investments during their first 3 months. The maximum bonus for each of you is €1,000. Take this opportunity to earn rewards, grow the SAVY community, and help your friend discover how money can work for them.

About SAVY

On the SAVY platform, peer-to-peer lending began in Lithuania in 2014. Today, we are one of the leading investment and financing platforms in the country, recognized for our responsible approach and transparency.

Our goal is to provide an alternative to traditional financing methods, where money works for people, not banks. We believe in transparency, reliability, and financial awareness — which is why we create a space where everyone can invest responsibly and obtain loans on fair terms.

Read more about our journey, values, and team here.

€160+ M

Total loan value issued

36,000+

Consumer and business loans granted

16,3%

Portfolio weighted average interest rate

17,400+

Community of active investors

€24+ M

Total interest paid to investors

Your feedback matters to us

News

Key 2025 Achievements and a Look Ahead

2025 was truly a breakthrough year for SAVY. Our platform grew not only in numbers – we strengthened our position as one of the most reliable non-bank financing alternatives by…

When an investment returns not in euros, but in meaning

This Christmas once again showed the power of community. Together with our investors, we raised €5,000, which turned into a Christmas miracle and support for children who need it most….

What is XIRR and how do we calculate it on the SAVY platform?

XIRR is the actual return, calculated by taking into account the exact timing and amounts of the investor’s cash contributions and withdrawals. This metric allows for a more accurate assessment…

Frequently asked questions

About SAVY and how it works

What is SAVY?

SAVY is the first peer-to-peer lending and crowdfunding platform in Lithuania, operating since 2014, connecting people who want to borrow with those who want to invest in consumer and business loans. SAVY is supervised by the Bank of Lithuania and operates with all the necessary licenses for its activities.

How does SAVY work?

Loan applicants submit their applications, and the SAVY platform responsibly evaluates and approves applications that meet the requirements, offering loan terms based on the assessed risk of the client. Investors fund these loans in portions, which allows both parties to receive better terms – without payday lenders or banks.

How is SAVY different from banks and payday loan companies?

Banks lend from collected deposits, while other credit institutions (including banks) may lend using borrowed funds from other financial institutions or their own capital. Here, people lend to each other, and the platform itself also invests in a portion of the loans. As a result, loan terms are often more favorable, the process is faster, and decisions are more flexible. For investors, it is safer when SAVY invests alongside them.

How much can I borrow?

The maximum loan amount depends on the type of loan. For example, the largest possible consumer loan is €35,000, while the maximum mortgage loan secured by real estate is €200,000. The maximum loan also depends on factors such as creditworthiness, income, and the specific financial situation. Each case is assessed individually, and a loan offer is provided with the best terms for your situation.

Is SAVY’s activity safe and regulated?

Yes, SAVY is safe and regulated.

We are supervised by the Bank of Lithuania and operate under EU regulations. Investor funds are kept in a separate account at a licensed payment institution, meaning your money remains protected even if the platform ceases operations. In such a case, loan administration would be continued by an independent company approved by the Bank of Lithuania.

Consumer loans

How much can I borrow with SAVY?

With SAVY, you can quickly borrow up to €35,000 for up to 10 years to cover a wide range of personal needs.

How can I get a small online loan quickly through SAVY?

The SAVY peer-to-peer lending platform can provide a loan in as little as one day. Submit your loan application online, and the SAVY team will assess your creditworthiness. If your application meets the requirements, you’ll sign the agreement and the loan amount will soon be transferred to your account. So, if you need a quick and easy loan, SAVY is an excellent choice.

How quickly will I receive the funds after submitting my application?

Loans are usually provided within one day. Although many investors contribute to a single loan, you’ll receive your SAVY loan very quickly because applications are assessed as fast as with payday lenders. Most of the loan funding is done automatically using an investment tool according to investors’ pre-set criteria.

What are the loan terms and interest rates?

The cost of a loan consists of the interest paid to investors and the one-time and monthly service fees charged by the SAVY platform.

The amount of interest and fees depends on your financial situation and credit history. In many cases, SAVY’s rates are lower than those of payday lenders, and we offer more flexible lending than traditional banks.

For more detailed information, please visit our service fees page.

Can I get a loan if I already have existing financial obligations?

SAVY loans can be granted to individuals with existing financial obligations, but the decision is made based on an assessment of individual creditworthiness. Factors that influence the decision include the size of current obligations, income and its stability, as well as credit history.

Does SAVY offer loans without a credit check?

No, this option is not available. One of the most important steps in granting a loan is assessing the applicant’s creditworthiness. The SAVY team takes this process very seriously to minimize risk for investors and to protect the borrower from excessive financial burden or default.

Are loans provided without collateral?

Yes, with SAVY you can get a personal loan without any collateral.

How to pay installments?

There are several ways to make your loan repayments:

- Through the SAVY self-service portal.

- By bank transfer.

- By initiating a payment via the link included in the invoice sent by email. An invoice with the payable amount is sent at the beginning of each month.

- At Perlo terminals.

Bank account details for making payments:

Recipient name: UAB Bendras finansavimas

Recipient code: 30325952

Recipient account: LT153500010002003880

Payment reference: borrower’s personal ID number (mandatory)

Paying from a Paysera account:

Recipient name: UAB Bendras finansavimas

Recipient account: EVP4410002003880

Payment reference: borrower’s personal ID number (mandatory)

Important: These details cannot be used for identification purposes.

To repay your loan early, please contact us by phone at +370 (5) 272 0151 or by email at labas@savy.lt.

Can I repay the loan early?

Yes, you can repay the loan early. To do so, please contact us by email at labas@savy.lt or by phone at +370 (5) 272 0151. We will create a request in the SAVY self-service portal, which you will need to complete by specifying the planned early repayment date so that we can calculate the exact amount to be repaid.

What should I do if I can’t repay my loan on time?

The most important thing is to communicate before your payment is late. If you cannot make your loan payment on time, contact us by phone at +370 (5) 272 0151 or by email at labas@savy.lt so we can find a solution together.

Business loans

What is crowdfunding?

Crowdfunding is an alternative lending model where funds for individuals or businesses are collected from many private investors through a platform. SAVY acts as an intermediary between borrowers and investors, ensuring a transparent and efficient financing process.

The SAVY platform operates in accordance with the European Union Regulation (EU) 2020/1503, and its activities in Lithuania are supervised by the Bank of Lithuania. This ensures a high level of transparency, security, and consumer protection.

How much can I borrow through SAVY?

We offer business loans of up to €200,000. The maximum amount available to a specific company depends on factors such as the company’s operating history, financial situation, credit history, loan amount and term, collateral, and other circumstances.

How long does it take to get a business loan decision?

We evaluate a business loan application and inform clients about the lending decision within 1 business day after all documents are submitted.

What documents are required to get a business loan?

- Company’s financial statements: profit (loss) statement and balance sheet

- Bank account statements

- Shareholders’ signed consent for client creditworthiness assessment

In some cases, we may request additional information.

What are the possible loan collateral options?

For loans up to €50,000, a shareholder guarantee and promissory note are required. For loans exceeding this amount, collateral is necessary – this may be real estate or other assets.

What types of businesses can apply for a loan?

Various types of businesses can apply for a loan through SAVY:

- Public limited companies (AB)

- Private limited companies (UAB)

- Small partnerships (MB)

- Non-profit organizations (VšĮ)

- Self-employed individuals

- Farmers

Each business loan application is evaluated individually.

Do you provide loans to new businesses?

Yes. If your business has been operating for at least 12 months, we invite you to submit a business loan application. We will assess your eligibility to finance your business.

Is a loan available for starting a business?

SAVY does not provide loans to newly established businesses, businesses that have not yet started, or those operating for less than one year. Loans are only available to companies that have been in operation for at least one year.

What are the business financing terms?

The cost of a business loan depends on the company’s operating history, financial situation, credit history, loan amount and term, collateral, and other factors.

You can find more detailed information on the service fees page.

How can I repay my loan?

There are several ways to make your business loan repayments:

- By bank transfer.

- By initiating a payment via the link included in the invoice sent by email. An invoice with the payable amount is sent at the beginning of each month.

Bank account details for making payments:

- Recipient name: UAB Bendras finansavimas

- Recipient code: 303259527

- Recipient account: LT153500010002003880

- Payment reference: borrower’s company registration number (mandatory)

Paying from a Paysera account:

- Recipient name: UAB Bendras finansavimas

- Recipient account: EVP4410002003880

- Payment reference: borrower’s company registration number (mandatory)

Important: These details cannot be used for identification purposes.

To repay your loan early, please contact us by phone at +370 (5) 272 0151 or by email at labas@savy.lt.

Can I repay my business loan early?

Yes, you can repay your loan early. To do so, contact us by email at labas@savy.lt or by phone at +370 (5) 272 0151. To calculate the exact amount for early repayment, you will need to submit a request in the SAVY self-service portal, indicating your planned early repayment date.

What should I do if I’m unable to make my loan payment on time?

The most important thing is to communicate before your payment is late. If you cannot make your loan payment on time, contact us by phone at +370 (5) 272 0151 or by email at labas@savy.lt so we can find a solution together.

Investing on the SAVY platform

What is P2P investing?

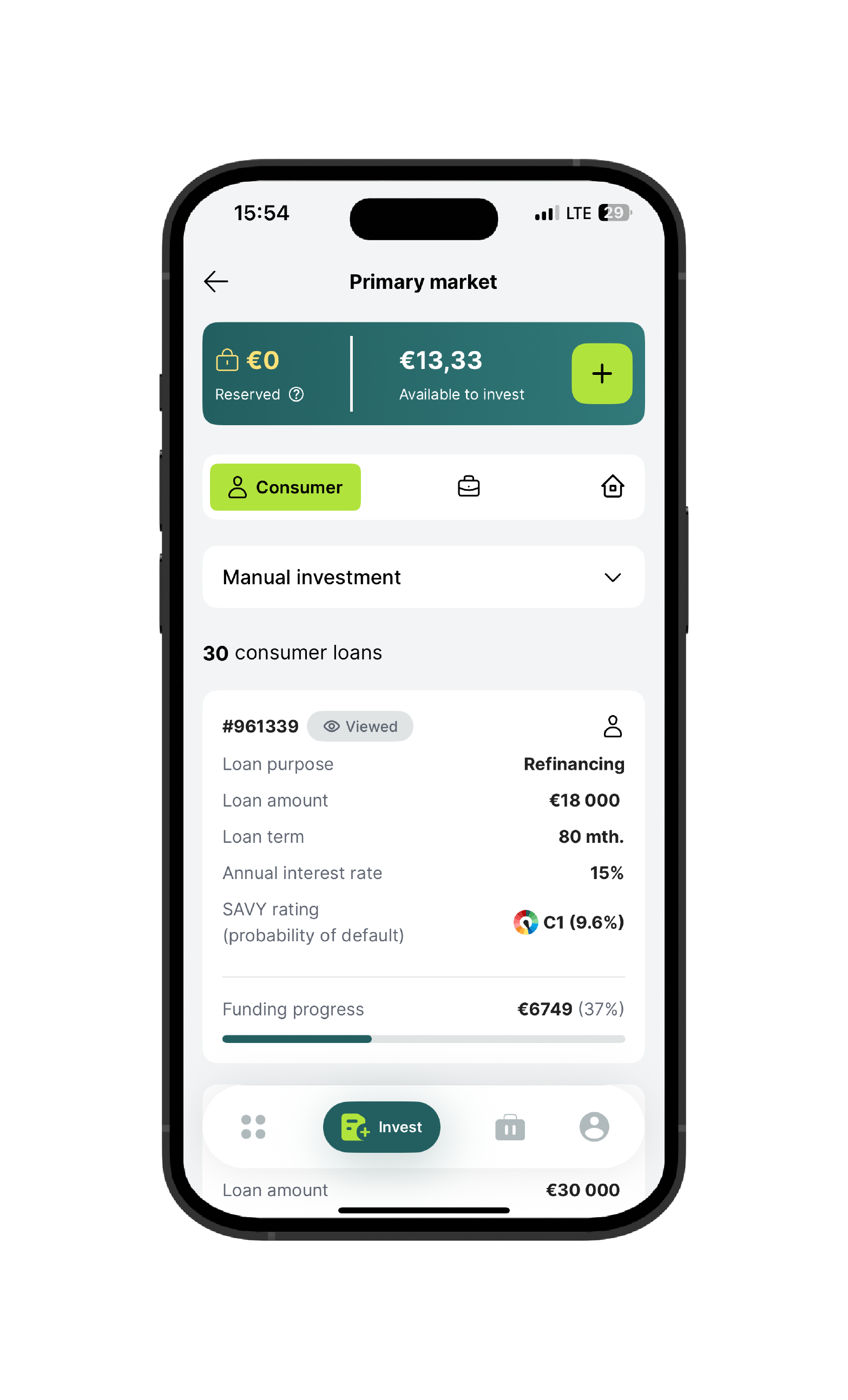

The term may sound complicated, but its meaning is simple – P2P, short for Peer-to-Peer, is a way for people to lend to other people by investing in consumer loans through a platform. If you’re looking for a reliable P2P platform for your investments, SAVY is an excellent choice.

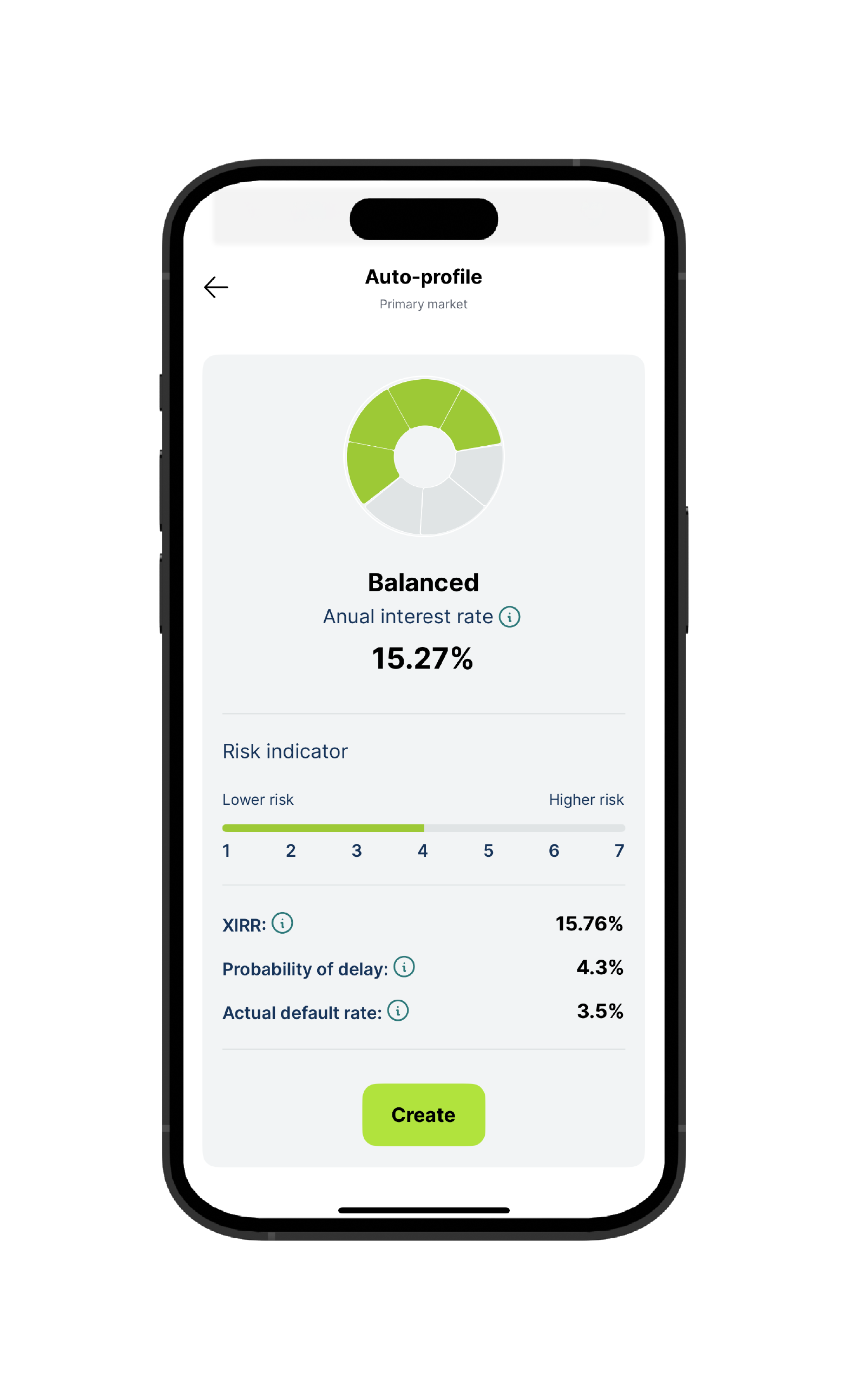

How can I start investing with SAVY?

Becoming an investor is easy. Follow these steps:

- Create an investor account.

- Connect an existing Paysera account or open a new one.

- Set up auto-investment profiles and/or invest manually.

- Manage your investment portfolio. Stay active by updating your auto-invest profiles and buying or selling on the secondary market.

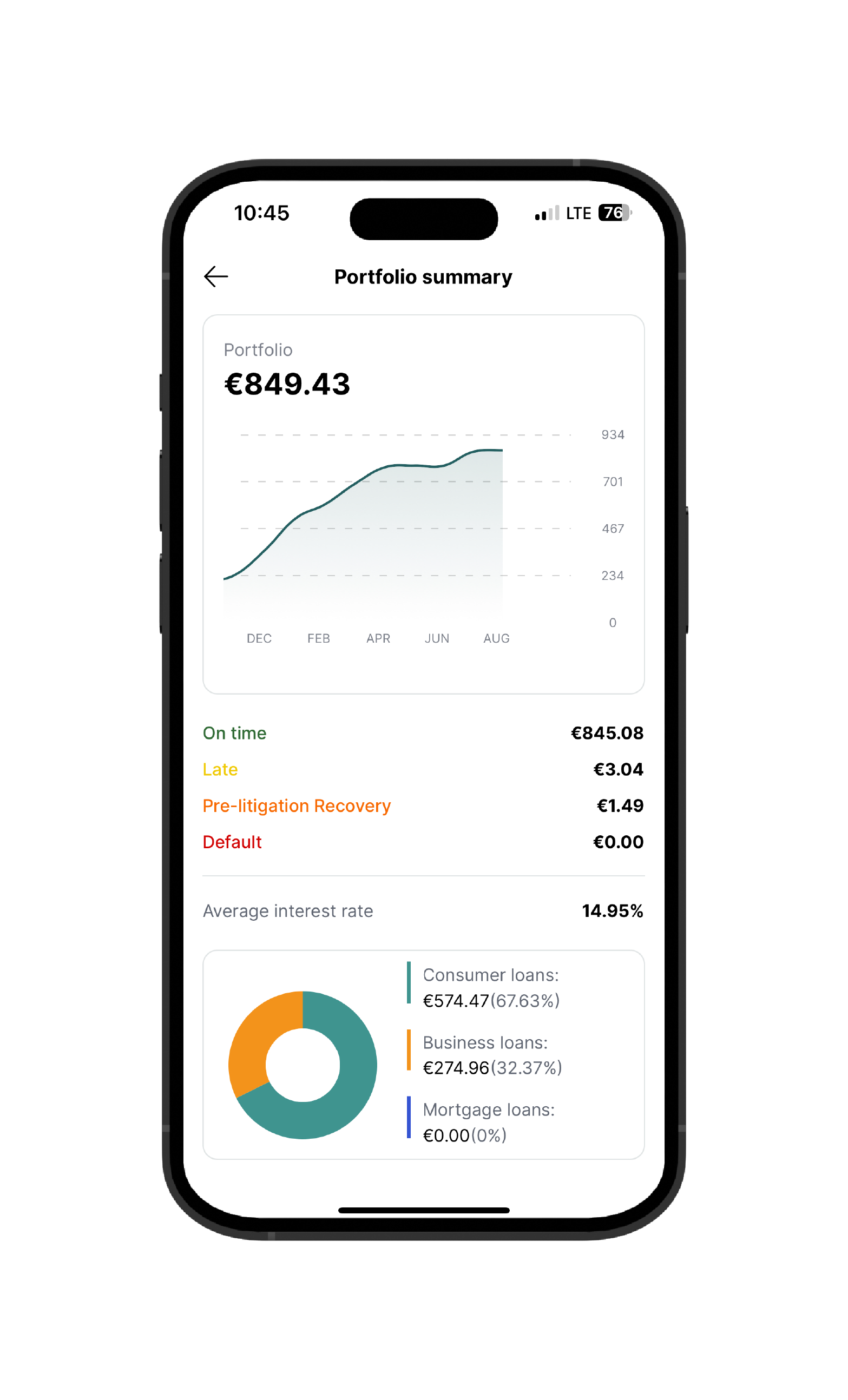

What returns can I expect on my investments?

The average weighted interest rate of the SAVY loan portfolio is 15.7%. You have a high chance of earning double-digit returns. Please remember that all investing involves risk.

What are the risk factors when investing through SAVY?

Risks of peer-to-peer lending (loans to individuals):

- Borrower default

- Lack of liquidity

- Tax environment risks

- Risk of borrower bankruptcy

- Risk of changes in unemployment rates

Risks of crowdfunding (business loans):

- Risk of changes in project circumstances

- Lack of liquidity

- Risk of insufficient or misleading information

- Risk of legal disputes

- Risk of bankruptcy of the project owner or guarantor / promissory note issuer

- Tax environment risks

For more details, please visit our page about investment risk management.

Can I diversify my investments?

Yes. It’s worth diversifying your investments by spreading them across multiple loans. The minimum investment in a single loan is just €10.

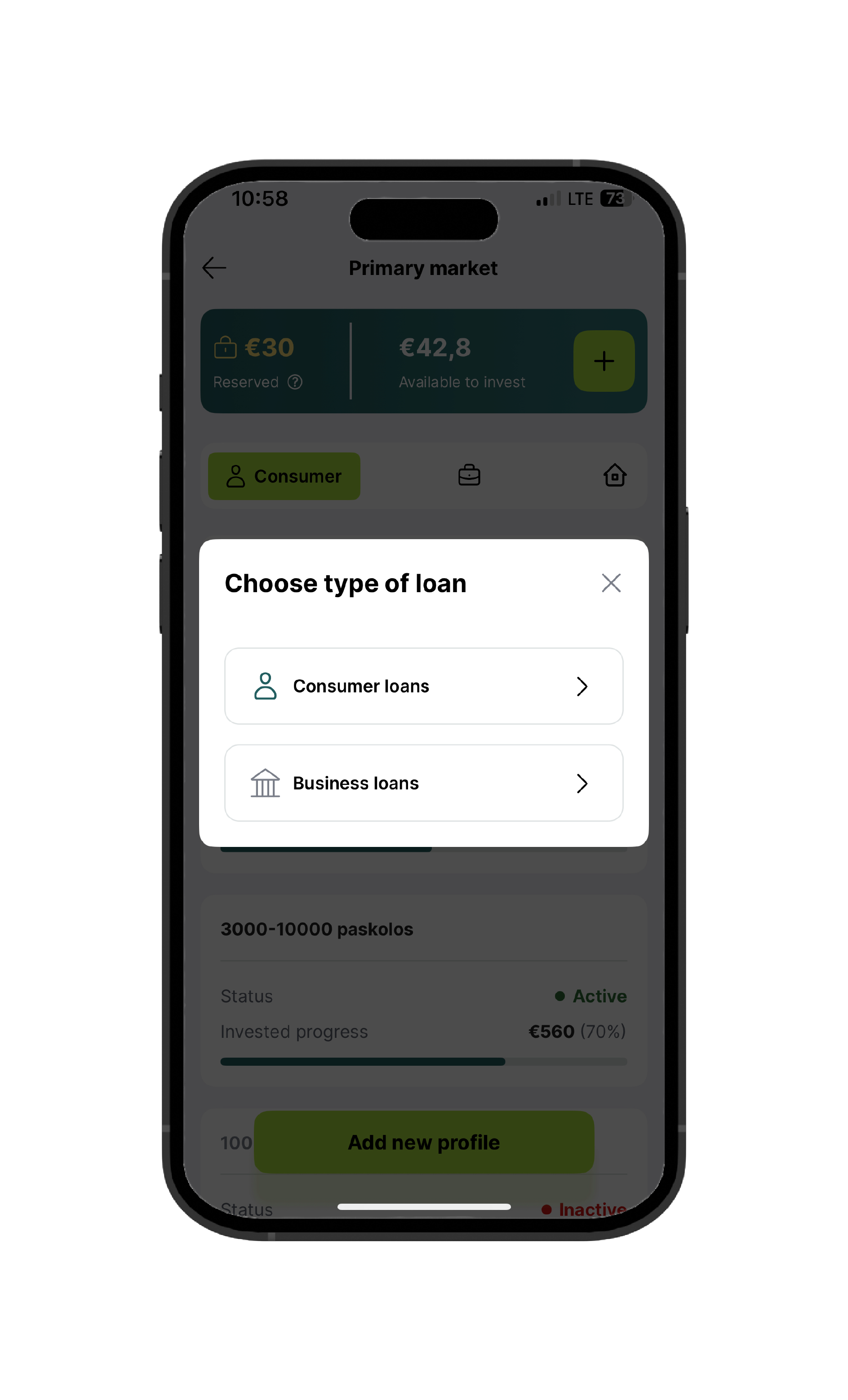

On the SAVY platform, there are four different products, each with its own benefits and characteristics, that you can invest in:

- Consumer loans

- Business loans

- Mortgages secured by real estate

- Real estate development loans

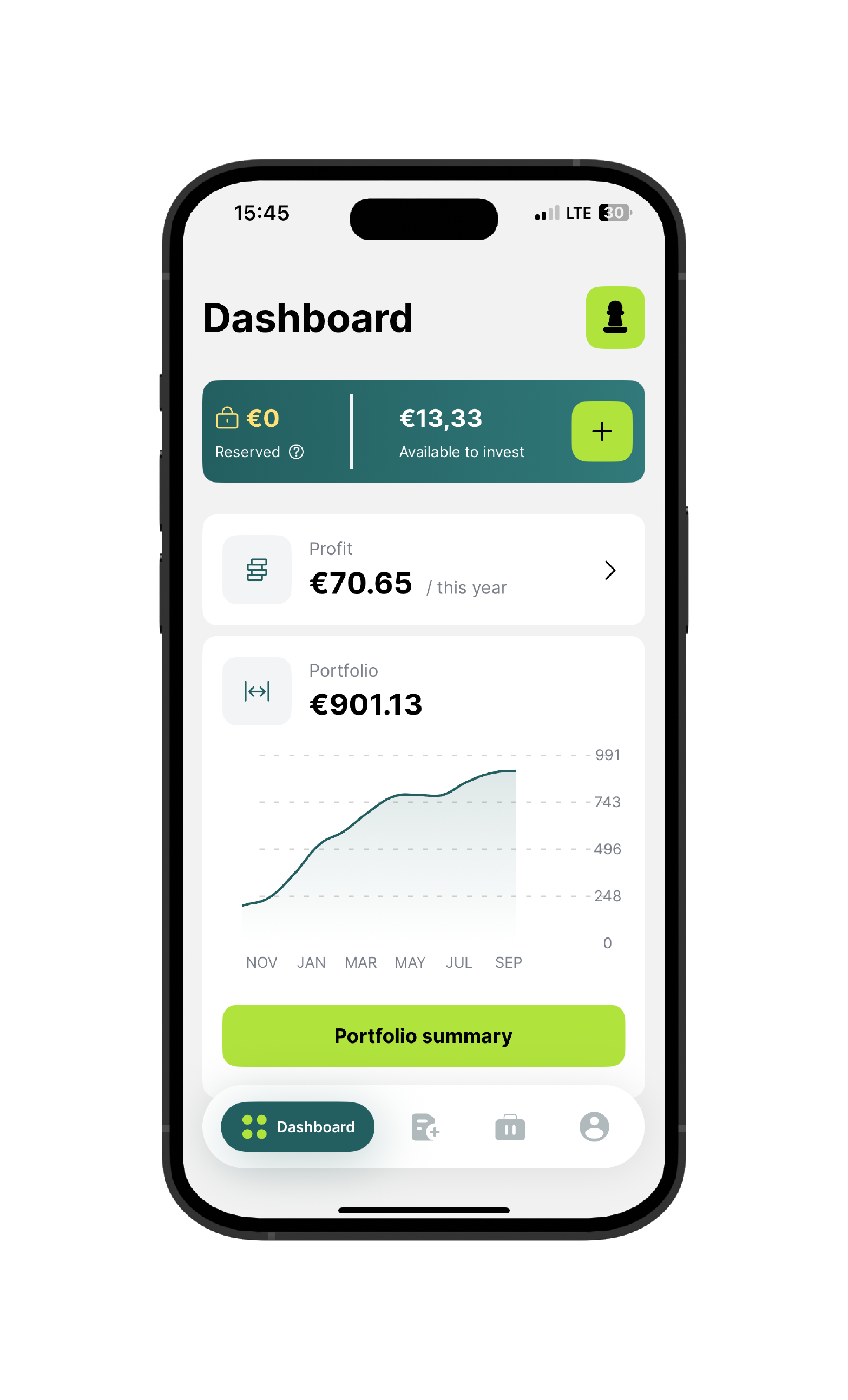

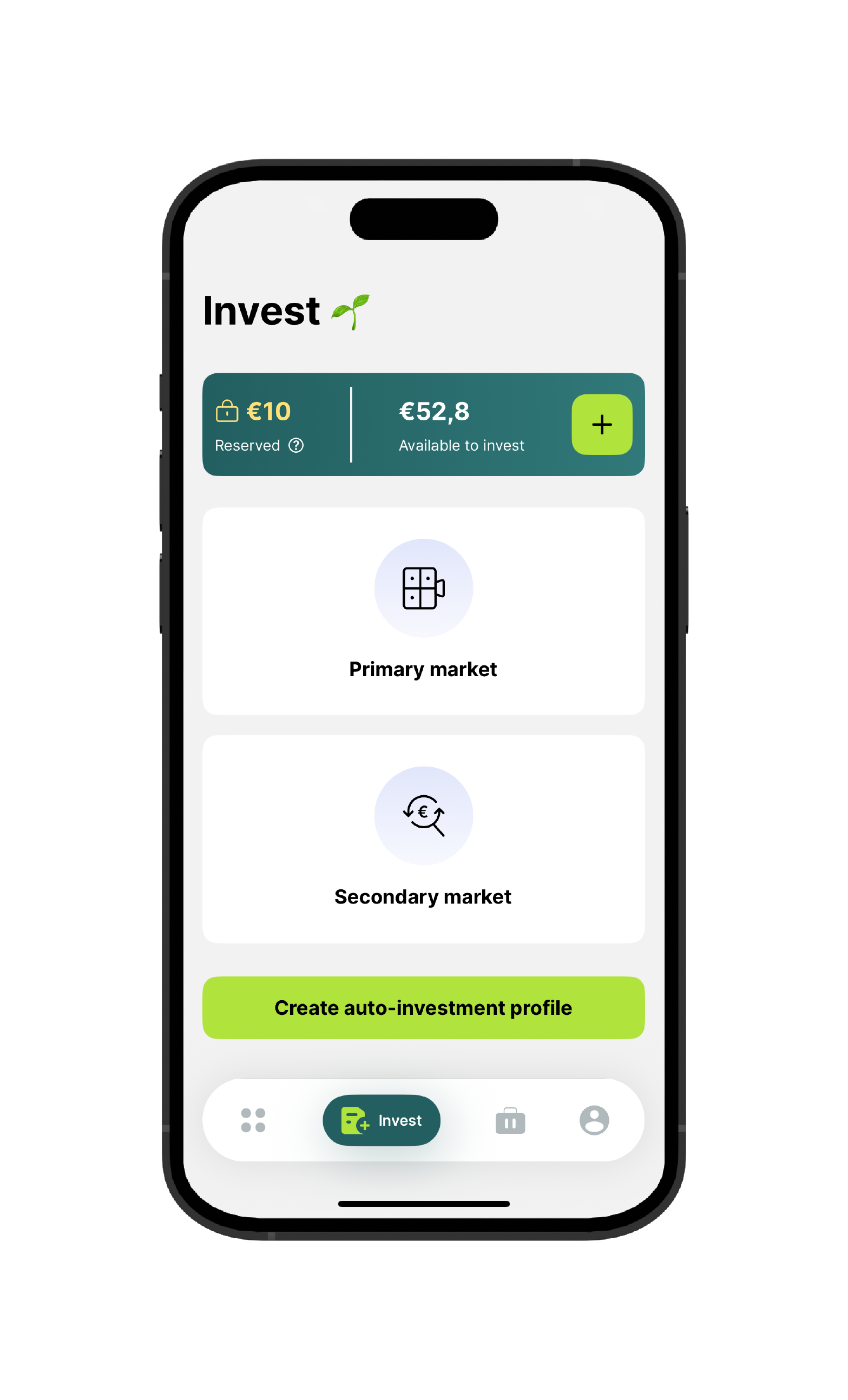

Why should I download the SAVY app?

Having the SAVY mobile app is convenient and useful. With it, you can:

- Invest in the primary market

- Set up auto-investment profiles

- Buy and sell investments on the secondary market

- Track your earned profits

- Monitor the status of your investment portfolio

We invite you to download the SAVY mobile app from Google Play or the App Store.

How can I withdraw my investments from SAVY?

To withdraw your existing SAVY investments, you have two options:

- Sell your investments on the secondary market, with or without a discount.

- Wait for the investments to return to your personal Paysera account. If you have active auto-investment profiles, we recommend turning them off to prevent automatic reinvestment.

By logging into your SAVY account, you can always see your available balance. All funds not currently invested are held not by SAVY, but in your own Paysera account. You can withdraw money from this account at any time by transferring it to another bank account of your choice.

Other common questions

How can I register as a SAVY client?

- If you want to start investing on the SAVY platform, create an investor account here.

- If you want to apply for a personal loan, fill out the application. A user account will be created for you during this process.

- If you want to apply for a business loan, fill out the application for business. A user account will be created for you during this process.

Who can use the SAVY app?

The SAVY app is designed for investors and personal loan clients.

Investors can use the app to:

- Invest in the primary market

- Set up auto-investment profiles

- Buy and sell investments on the secondary market

- Track earned profits

- Monitor the status of their investment portfolio.

Personal loan clients can use the app to submit a loan application.

The SAVY mobile app is available for download on Google Play and the App Store.

Can I use SAVY if I am not a Lithuanian citizen?

Who can use SAVY depends on the specific services we offer:

- Investing on the SAVY platform: available to everyone, including citizens of Lithuania and other countries.

- Personal loans: available to Lithuanian citizens and those with a temporary or permanent residence permit in Lithuania.

- Business loans: available to legal entities registered in Lithuania.

How are clients’ personal and financial data protected?

Protecting your data is one of our top priorities. Personal information is processed in accordance with applicable European Union and Lithuanian laws, including the General Data Protection Regulation (GDPR).

We use advanced technical and organizational security measures: data is transmitted using secure SSL encryption protocols, and access to it is strictly controlled. All payments are processed through licensed payment service providers that meet the highest information security standards.

How can I contact SAVY customer support?

Write to us:

- For loans and general inquiries, email us at labas@savy.lt

- For investment-related questions, email investuoju@savy.lt

For urgent or important matters, call us during business hours: +370 (5) 272 0151

Our working hours:

- Mon-Fri: 8:00–19:00

- Sat: 10:00–18:00

- Sun: closed

On public holidays, our working hours are announced on Google search.

What fees apply to users and investors?

You can find all the SAVY service fees listed here.

How can I unsubscribe from marketing messages?

You can unsubscribe from marketing messages in several ways:

- You can unsubscribe from emails by clicking “Unsubscribe from newsletters” in the email itself.

- You can unsubscribe from SMS messages by clicking the SMS link in the SAVY message.

- You can manage notifications in your SAVY account under “Notification settings.”

- And you can always call us at +370 (5) 272 0151 or email us at labas@savy.lt to request withdrawal of your marketing consent.

Fraud prevention

What are the most common types of fraud?

Fraudsters often pretend to be employees of banks or government institutions. They may send fake emails or SMS messages, call you, and ask you to verify your identity, provide login details, or make a payment for account verification.

Recently, investment scams have become very common. Scammers promise extremely fast and high returns by investing in cryptocurrencies or other instruments through fake platforms. They may even provide login access to fake investment platforms, where the victim sees their money supposedly earning fantastic returns on the screen, which encourages them to send even more money.

Another widespread method is romance scams. Scammers gradually gain trust through dating apps or social networks and later ask for financial help.

Fraud can also occur through fake online stores, where products are offered but never delivered.

All these schemes share one key feature – pressure to act quickly and trust without verifying information. If something seems suspicious, stop, check the details, and consult before taking any action.

How to protect yourself from fraud?

Fraudsters are becoming increasingly sophisticated, so it’s important to stay vigilant. Never share your login details, passwords, or personal information over the phone, email, or social media, even if it seems like a bank or other official institution is contacting you. Scammers often create a sense of urgency – asking you to make a payment or verify your identity via a suspicious link immediately. Before taking any action, stop, think, and verify that you are indeed communicating with the person or institution they claim to be.

If you have even the slightest doubt, contact us directly.

What should I do if I become a victim of fraud?

If you suspect that you have been targeted by a scam, or if you have already made a suspicious payment, contact your bank immediately – it may still be possible to stop the transaction or initiate a refund. Also, report the incident to the police without delay. If personal or login details were exposed, we recommend changing your passwords and enabling additional security measures, such as two-factor authentication.