It is important to understand the differences and advantages of the loan types available on the SAVY platform, as well as how to choose the most suitable product for you. At present, we offer the widest selection of investment opportunities. This means that on one platform you can invest in consumer, mortgage, business, and real estate development loans with different collateral options. Each loan is carefully assessed and clearly presented so that investors can make informed decisions. SAVY enables people…

It is important to understand the differences and advantages of the loan types available on the SAVY platform, as well as how to choose the most suitable product for you.

At present, we offer the widest selection of investment opportunities. This means that on one platform you can invest in consumer, mortgage, business, and real estate development loans with different collateral options. Each loan is carefully assessed and clearly presented so that investors can make informed decisions. SAVY enables people to act as a bank for each other by lending and receiving returns that match the risk. For your convenience, the SAVY mobile app lets you manage your investments, invest in new loans, and track results anytime.

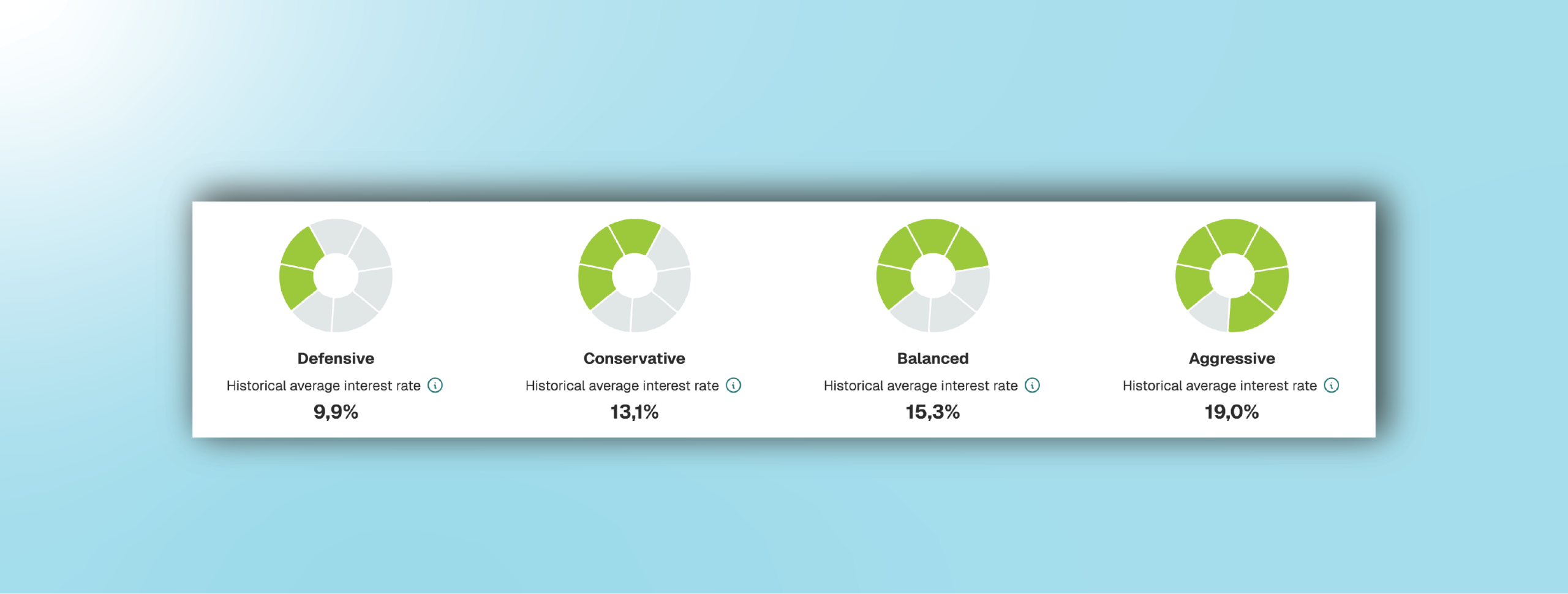

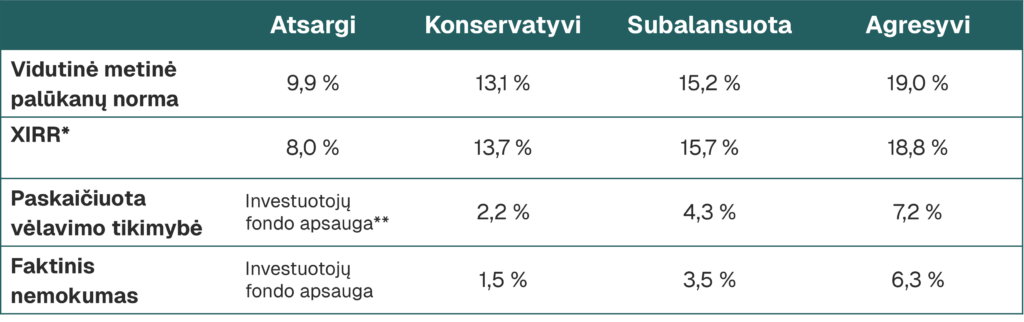

Now let’s look at the four investment opportunities that allow you to build your own strategy based on risk level, interest rate, and investment amount. Each of our four products can be tailored to different investor needs — both conservative and those willing to take on more risk.

Consumer Loans.

These stand out for offering the highest interest rates. The historical return of the entire portfolio is 16%, but your return will depend on your investment strategy and the credit ratings you choose. Loan amounts range from €300 to €30,000, with terms from 3 months to 10 years. The minimum investment per consumer loan is €10, while the maximum is €500. On SAVY, you can use a unique Investor Fund tool to help manage risk. By investing with Investor Fund protection, you will receive lower interest (as part of it goes to the fund), but if the borrower is late for 90 days in a row, the fund will repay the outstanding investment and accumulated interest for those 90 days. Consumer loans are best suited for those seeking higher returns and willing to accept greater risk.

Mortgage Loans.

These are the safest loans, secured by real estate. The average return is around 9%, with an average duration of about 116 months, attracting more conservative investors who prioritize safety and long-term stability. The minimum investment is €100, and the maximum is €1000. Real estate collateral provides additional protection to investors — if the borrower cannot repay the loan, the mortgaged property would be used to cover it. Importantly, in SAVY’s history, there has not been a single mortgage loan delayed for more than 90 days.

Business Loans.

These loans typically have shorter terms, usually less than two years. The average return is also double-digit — around 13%. The minimum investment per loan is €10, and the good news is that there is no maximum limit. Business loans are secured by guarantees, promissory notes, and for larger amounts, by pledging real estate or other assets. These guarantees help recover funds in the event of borrower default. SAVY handles all recovery procedures.

Real Estate Development Loans.

These loans provide short-term investment opportunities, typically up to one year, with an average return of around 12%. The minimum investment per loan is €10, and, as with business loans, there is no maximum. They are secured by mortgaged real estate. This is a great option for those interested in real estate development and who want to benefit from this market sector.

In summary, each of these investment products has its own unique advantages tailored to different investor needs.

-

Consumer loans — high interest rates and relatively quick returns with moderate risk.

-

Mortgage loans — stability and long-term returns with lower risk.

-

Business loans — opportunities to invest in growing businesses with significant short-term returns.

-

Real estate development loans — short investment terms and attractive returns, while contributing to real estate growth.

Every investor can find the option that best suits their financial goals, risk tolerance, and preferred investment horizon.

Choose the investment that fits your needs and start growing your capital today!

We remind you that investing is always associated with risk. This information does not constitute an investment recommendation, and past returns do not guarantee future results.