What is XIRR and how do we calculate it on the SAVY platform?

XIRR is the actual return, calculated by taking into account the exact timing and amounts of the investor’s cash contributions and withdrawals.

This metric allows for a more accurate assessment of investment profitability, especially when payments are uneven or irregular.

On the SAVY platform, XIRR helps investors understand the actual return they receive, taking into account the likelihood of loan delays.

Principles of XIRR calculation

Repaid and lost investments (PAID and LOST)

We use actual cash flows and their dates.

Active investments (OPEN)

We assume that payments will be made according to the schedule, so future cash flows are projected based on the current repayment schedule.

Investments transferred to pre-legal (out-of-court) collection (COLLECT)

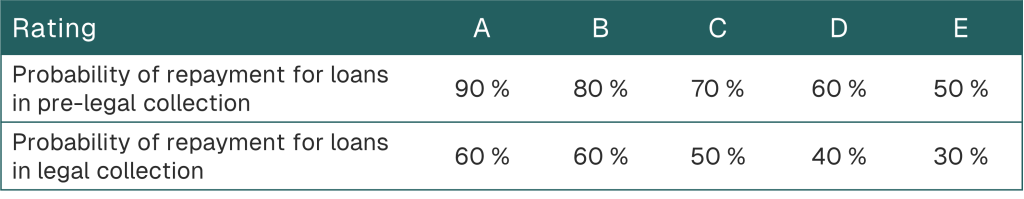

For future cash flows of loans in pre-legal collection, a recovery probability calculated based on the loan rating is applied. The repayment probabilities of loans in pre-legal and legal collection are shown in the table below. When estimating future cash flows for loans in pre-legal collection, each rating is assigned a corresponding probability of fund recovery (for example, for A-rated loans in pre-legal collection, a 4% (0.1 × 0.4 = 0.04) discount is applied to the cash flows; for B-rated loans, an 8% (0.2 × 0.4 = 0.08) discount is applied, and so on).

Since loans in pre-legal collection make payments with an average delay of 3 months, the projected payments are also postponed by 3 months, which reduces the XIRR value.

Investments transferred to legal collection (DEFAULT)

The probability of recovery over 6 years is assessed, depending on the loan rating (see the table below). The final payment for loans in legal collection is evaluated conservatively and is deferred by 72 months from the loan termination date.