Invest in loans

Here, it’s people who earn — not banks! Invest in consumer, business, mortgage, and real estate development loans, and enjoy regular passive income.

€160+ M

Invested through the platform

17,400+

Active investor community

16,3%

Portfolio weighted average interest rate

€24+ M

Investors earned

87%

Recommended by investors

Active investment offers

360

Interest 9.2%

Reitingas B1

Loan amount 20000 €

Term 120 months

Loan purpose Vehicle

Įsipareigojimų ir pajamų santykis 19.66%

Miestas Šiaulių r. sav.

Loan No. 964992

148

Interest 9%

Reitingas C1

Loan amount 55000 €

Term 120 months

Loan purpose Refinancing

Užtikrintumo priemonės Nėra

LTV 36.67% (max 36%)

Loan No. 964706

Investment returns calculator

SAVY – an investment and financing platform, the pioneer of peer-to-peer lending culture in Lithuania. Supervised by the Bank of Lithuania, we ensure sustainable, reliable, and stable growth, proven by multiple “Gazelle” fastest-growing company awards and “TOP Company” business stability certificates.

Earn regular returns by investing in loans for people and businesses!

Sign up for a free consultation

Why invest with SAVY

High investment returns

SAVY investors receive some of the highest annual interest rates on the market, depending on the chosen risk level. Average loan interest rates range from 5% to 30%, with the weighted average interest rate around 16%.

Easy to get started

You can start investing with as little as €10. This is the minimum investment for a single consumer or business loan. The minimum investment for a mortgage loan is €100.

Wide selection

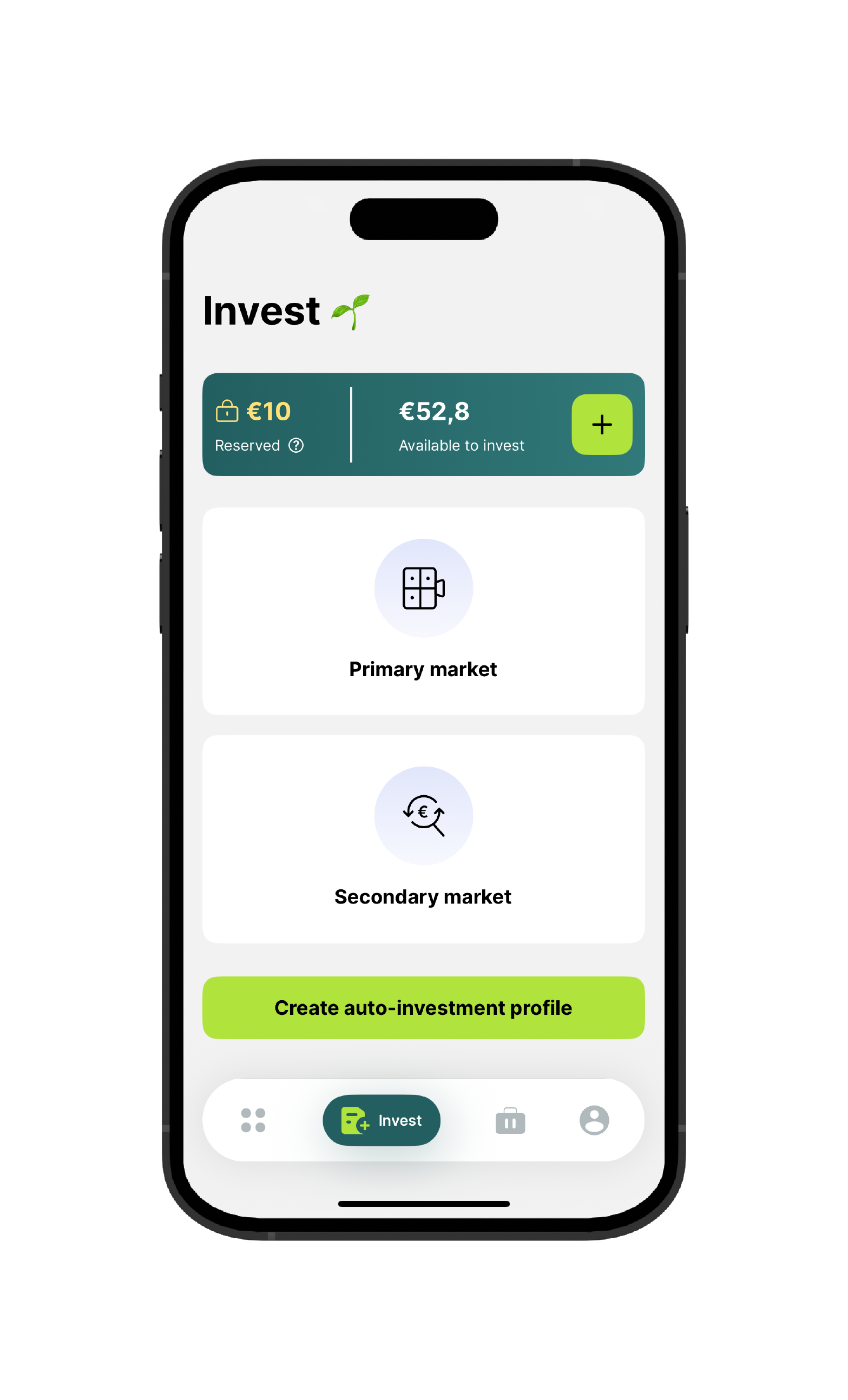

We are the only platform where you can invest in 4 types of loans – consumer, mortgage, business, and real estate development loans. Choose based on returns, terms, and security measures that match your appetite and risk tolerance.

Risk control

To reduce the risk of losses, choose Investor Fund protection. Its purpose is to compensate the investor if the consumer loan borrower fails to meet obligations for 90 consecutive days. When investing with the Investor Fund, a portion of the interest earned from the loan is paid into the fund, but in case of default, the fund compensates the investor for the unpaid loan amount and the interest accrued over 90 days.

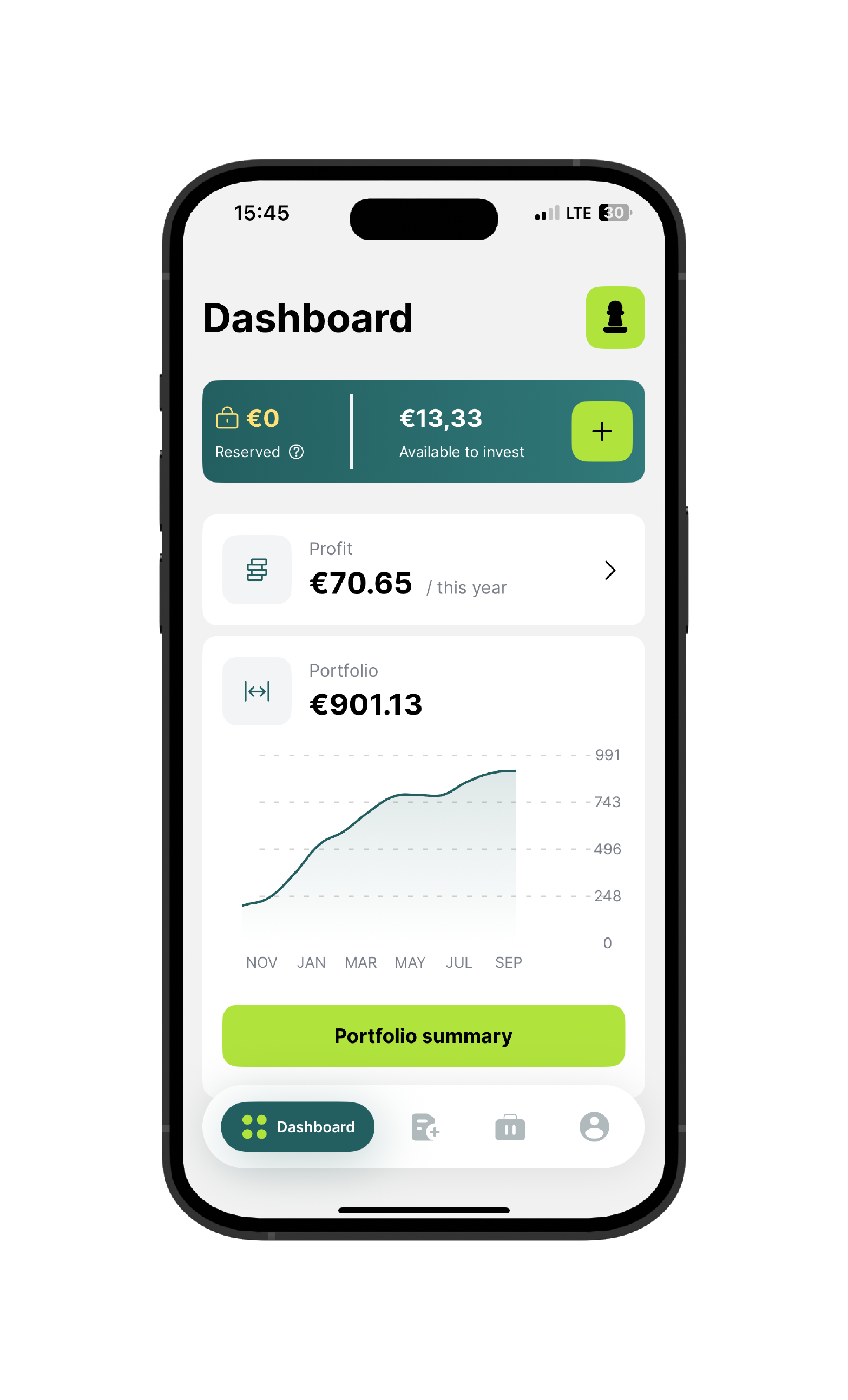

Simplicity

Investing is simple – choose an automated strategy that matches your risk tolerance or create your own. The platform clearly displays the risk level, collateral measures, and other key information to help you make informed decisions. For even greater ease, there’s the free SAVY mobile app.

Diversification

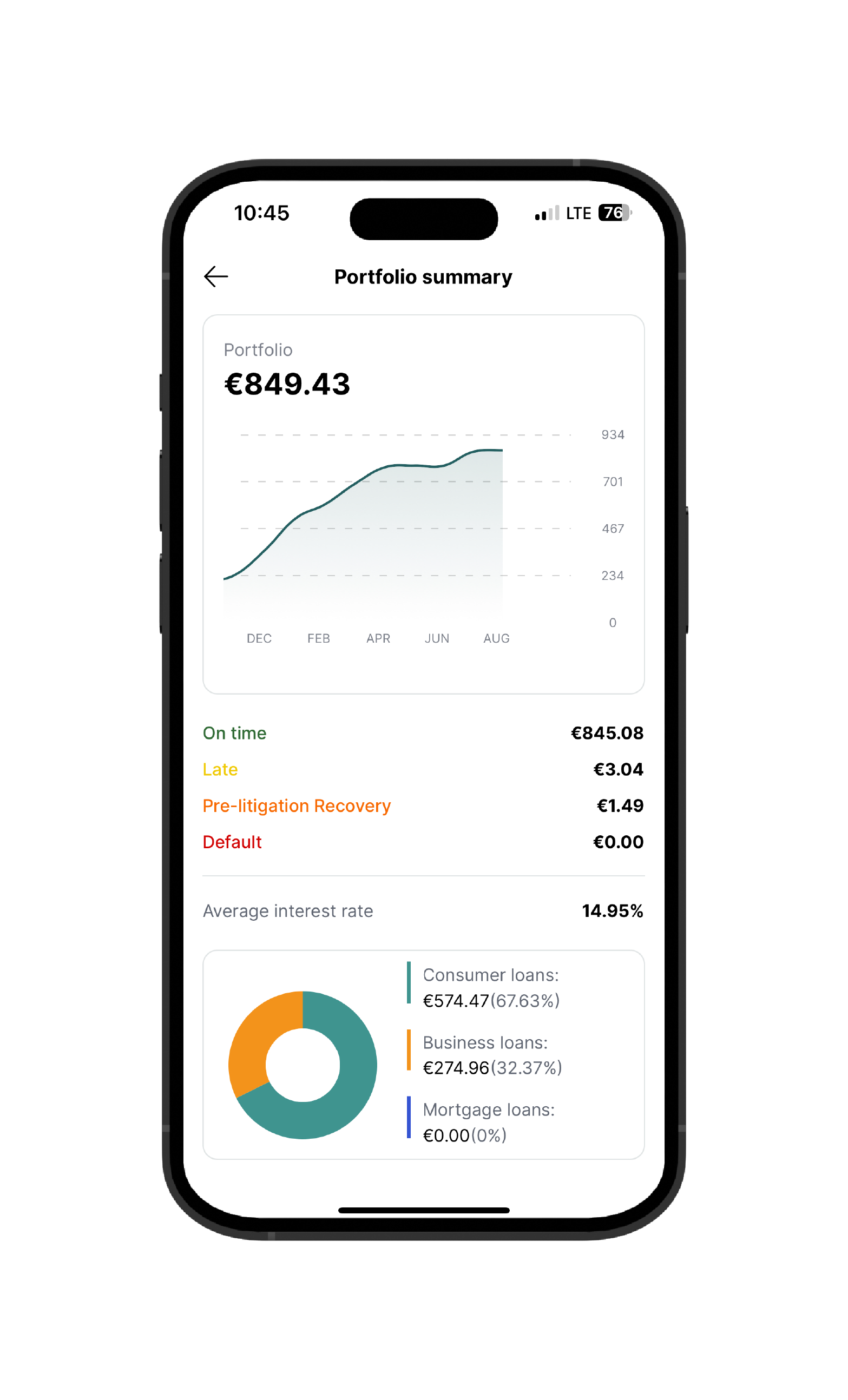

Diversify investments by loan type, return, term, collateral measures, and risk level – the more loans in the portfolio, the more stable the return. With SAVY, it’s easy to diversify your portfolio according to your desired strategy and increase its resilience.

Welcome present

Try investing for free for the first 6 months. If you decide to continue, a €1/month Investor Service Fee will apply. There are no withdrawal or other hidden fees, and you will receive interest on the entire invested amount.

Liquidity

At any time, you can quickly and conveniently sell your investments on the secondary market at a premium, discount, or at cost.

What’s important to know about SAVY investment opportunities

Investment risk

Lending investments carry certain risks. Every investor who wants to put their money to work through the SAVY peer-to-peer lending platform must familiarize themselves with the potential risks and assess whether these risks are acceptable to them.

Investors' fund

The Investors' fund is an additional risk management tool designed for those investing in consumer loans. The concept is simple – the investor forgoes a portion of the interest, but if the borrower fails to meet their obligations for 90 consecutive days, the Investors' fund compensates the investor for the unpaid portion of the investment and the interest accrued during that period.

Secondary market

Secondary market – this is the main tool for ensuring investment liquidity. Here, investors can buy and sell investments in already issued loans, i.e., the rights to claim from borrowers. If an investor needs to recover funds faster, they can sell their investment to other platform users. The new owner of the investment assumes all associated rights and continues to earn interest.

SAVY loyalty program

SAVY loyalty program provides additional benefits depending on the size of the investment portfolio. The larger the active loan portfolio on the platform, the more valuable privileges investors receive.

Refer a friend and you both earn up to €1,000

The best things come from sharing! Refer a friend to invest with SAVY and you’ll both receive 1% of your friend’s investments during their first 3 months. The maximum bonus for each of you is €1,000. Take this opportunity to earn rewards, grow the SAVY community, and help your friend discover how money can work for them.

Your feedback matters to us

News

State Portfolio Guarantees Enter Crowdfunding: €5.3 Million in Business Lending

Small and medium-sized enterprises (SMEs) in Lithuania are gaining new alternative financing opportunities. The investment and financing platform “Savy”, in cooperation with the national development bank ILTE, is introducing a…

Key 2025 Achievements and a Look Ahead

2025 was truly a breakthrough year for SAVY. Our platform grew not only in numbers – we strengthened our position as one of the most reliable non-bank financing alternatives by…

When an investment returns not in euros, but in meaning

This Christmas once again showed the power of community. Together with our investors, we raised €5,000, which turned into a Christmas miracle and support for children who need it most….

Newsletter for investors

Subscribe to the SAVY newsletter for valuable insights and tips on investing.

Questions and answers about investing

What is the best investment platform?

When choosing the best investment platforms in Lithuania, it is important to consider their advantages, benefits for investors, and your own needs and capabilities. Investing is a great way for anyone to make their money work and grow their capital, but success depends on selecting the right platform. Evaluate what investment opportunities a platform offers, the fees for investors, and the investment terms. It is also crucial to check whether the platform is supervised by the Bank of Lithuania, whether it is reliable, operates transparently, and provides regular activity reports. Equally important is usability—having the option to manage your investments via a mobile app is a big advantage. The SAVY investment and financing platform meets these criteria, holding a strong position in the peer-to-peer lending and crowdfunding market, making it a safe and reliable choice.

I can lend money for interest: how to get started?

If you’re interested in lending money for interest, SAVY is a great option. Getting started is simple!

- Create an investor account on SAVY website or download the SAVY mobile app.

- Then, link an existing or open a new Paysera account, transfer funds for investing, and you’re ready to go.

- You can manually invest in selected loans, or for added convenience, choose an automated investment strategy or create custom automatic investment profiles.

- Reinvest the earned interest, and if needed, sell your investments on the secondary market.

Why is a Paysera account required?

Investing through the SAVY platform is only possible using a Paysera account. This provides an extra layer of security – investors’ funds are held in a personal account, separate from the platform. To start investing, you need to open an account with Paysera, an electronic money institution regulated by the Bank of Lithuania. The account is completely free for individuals and can be opened in just a few minutes by completing the registration form and verifying your identity. Currently, investing is only available via Paysera, but options are planned to expand in the future.

Is it possible to have both a borrower and an investor account?

An individual can have both a borrower and an investor account, but they must be registered with different email addresses. To become an investor, sign up on the SAVY website or download the SAVY mobile app. After registration, follow the instructions sent to your email.

What is KYC and why do you need to complete It?

SAVY ensures the prevention of money laundering and terrorist financing by applying the “Know Your Customer” (KYC) principle – a set of processes designed to verify a client’s identity, understand the origin of their funds, and assess the risk of money laundering or terrorist financing associated with them.

In compliance with the Law on the Prevention of Money Laundering and Terrorist Financing of the Republic of Lithuania and other legal requirements, we must collect certain information about our clients and their funds both before and during business relationships. Clients are required to complete special KYC questionnaires and provide information about their activities, financial situation, and the source of their funds.

Once the information is received, SAVY evaluates it and, if necessary, may request additional data or documents to ensure accuracy and compliance with legal requirements. Clients are also asked to periodically update their information. Failure to provide the required information may result in temporary restrictions on services or, in extreme cases, termination of the business relationship.

What is a politically exposed person (PEP) and why do we need to know?

A Politically Exposed Person (PEP) is an individual who currently holds, or has held within the past 12 months, an important public position, as well as their close family members or close associates. Clients identified as PEPs must undergo additional steps related to identity verification and the source of their funds. If you are not the PEP yourself, you may also need to clarify your relationship with the politically exposed person. This is required by law, and failure to provide the necessary information may result in temporary restrictions on services or, in extreme cases, termination of the business relationship.

Examples of important public positions include:

- Head of state, head of government, minister, deputy minister, state secretary, or chancellor of parliament, government, or ministry.

- Member of parliament.

- Member of a supreme court, constitutional court, or other high judicial institution whose decisions cannot be appealed.

- Mayor or director of a municipal administration.

- Member of the management body of the supreme state audit and control institution or central bank governor, deputy, or board member.

- Ambassador, chargé d’affaires, commander of the armed forces, military unit leaders, chief of defense staff, or high-ranking foreign military officer.

- Member of the management or supervisory board of a state-owned company or corporation where the state owns more than half of the voting shares.

- Member of the management or supervisory board of a municipality-owned company where the municipality owns more than half of the voting shares and the company is considered large under Lithuanian financial reporting law.

- Head, deputy, or management board member of an international intergovernmental organization.

- Leader, deputy, or management board member of a political party.

What is a politically exposed person (PEP) and why do we need to know this?

Legal entities wishing to start investing on the SAVY platform must first create an individual account and then complete the registration of the legal entity. To do this, click the “CREATE BUSINESS ACCOUNT” button in the top menu of your account, and all detailed information will be sent to your email.

What documents do legal entities need to provide to obtain permission to invest?

After creating a business account, you need to complete a 5-step questionnaire regulated by the Law on the Prevention of Money Laundering and Terrorist Financing of the Republic of Lithuania (LR) and related legal acts. This questionnaire includes:

- Information about the legal entity;

- Information about the director and other responsible persons;

- Information about the planned business activities;

- Additional questions;

- Uploading documents.

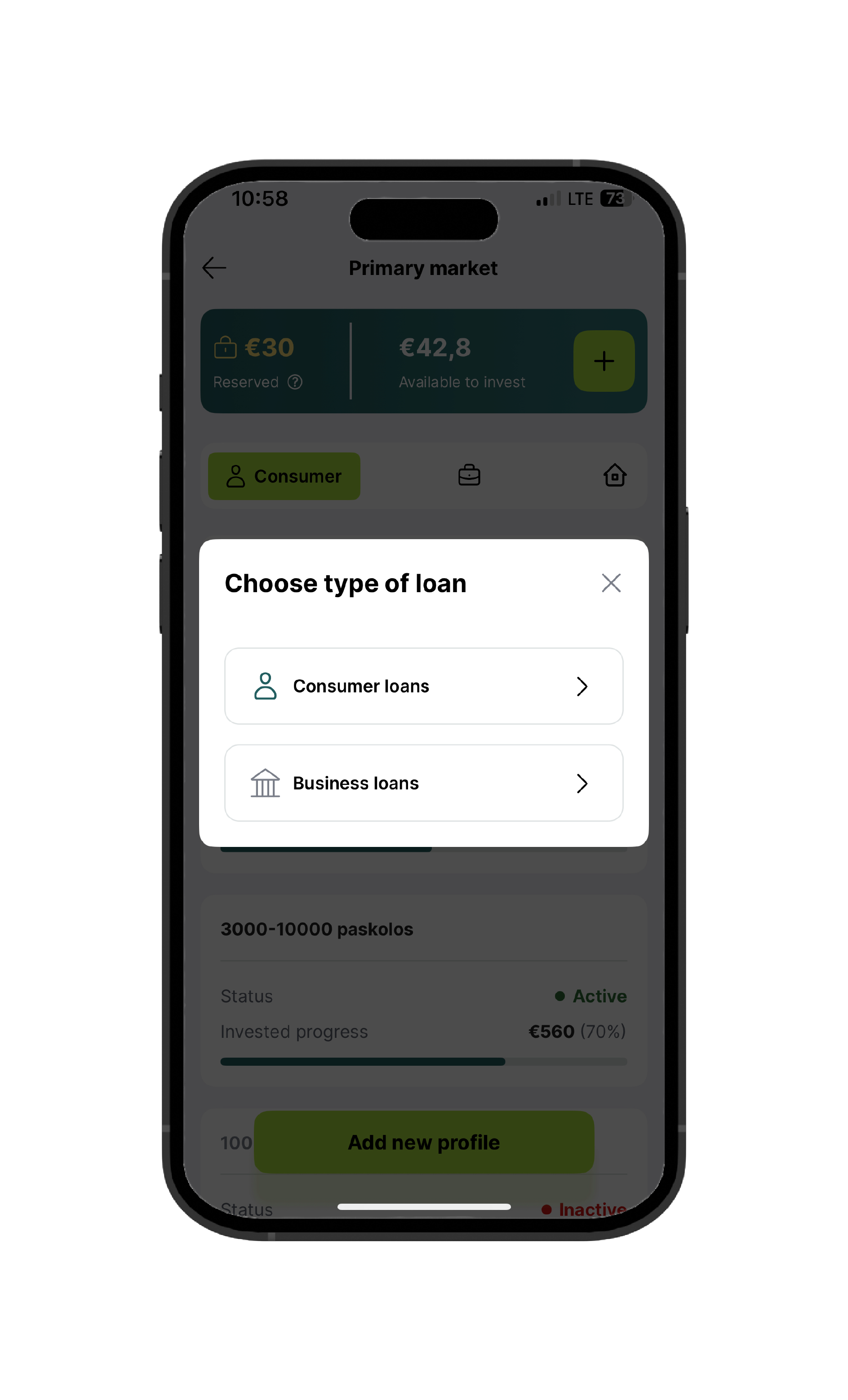

What types of loans can legal entities invest in?

Legal entities can invest in consumer loans and crowdfunding (business) loans. Lithuanian laws only restrict investing in mortgage loans (i.e., loans for individuals secured by real estate).

What amount can a business entity invest in a single loan?

A business entity can invest in consumer loans from 10 € to 500 €. This limit is set by the Lithuanian Consumer Credit Law and is the same as for individuals. For crowdfunding (business) loans, business entities can invest from €10, and there is no maximum investment limit. The number of consumer or business loans that can be financed is also unlimited.

From which account of a legal entity are loan investments made?

After creating a business account and completing the 5-step questionnaire, a legal entity must create an investment “Paysera” account – only then is permission to invest granted.

How are income earned through peer-to-peer lending/crowdfunding platforms accounted for and taxed?

Income is recorded on an accrual basis and is taxed according to the corporate income tax rates applicable to legal entities registered in Lithuania.

The accrual principle means that income is recognized in the accounting records not at the moment of receipt (cash inflow), but when it is earned—that is, when the right to the income arises. For example, if a legal entity grants a loan and, according to the loan agreement, is entitled to receive 500 € in interest over the loan term, the entire amount is recognized as income at the moment the loan is granted, regardless of when the interest is actually paid. If the loan is repaid early or part of it remains unpaid, the corresponding accrued but unreceived interest is written off as an expense.

How do legal entities receive information about their investments?

Investment reports for legal entities are conveniently accessible in the Business Account. They provide all the necessary information about investments: invested amount, received and receivable interest, late payment fees, accrued interest, secondary market gains/losses, overdue loans, active and inactive investments, investment-related expenses, and annual tax data. All this information is presented in a structured format, suitable for financial accounting and tax reporting.

Can business entities use the automatic investment tool?

Business entities, like individuals, can conveniently invest by creating individual automatic investment profiles or by choosing the automated strategies offered by the platform. Note that there are separate automatic investment profiles for business and consumer loans in both the primary and secondary markets. In total, up to 20 profiles can be created.

How can business entities protect their investments?

Legal entities, like individuals, can invest in consumer loans through the Investors’ Fund and protect their investments if the borrower fails to meet their obligations for 90 consecutive days. In such cases, investors receive lower interest, but the Investors’ Fund pays out the unpaid portion of the investment along with accrued interest for the 90-day period. If there are occasionally insufficient funds in the Investors’ Fund to cover all losses, compensations are paid on a first-come, first-served basis as soon as funds become available.

Do secondary market commission fees reduce corporate income tax?

Secondary market commissions are recorded as business operating expenses, which reduce taxable profit.

How to calculate investment return?

Use the return on investment calculator, which you can find at the top of the page. Enter the investment amount, the annual loan interest rate, the term, and indicate if the loan is repaid early. The calculator will provide a preliminary estimate of your potential profit.

Please note that each loan shows an annual interest rate, and the monthly interest rate is calculated by dividing it by 12. Borrowers repay the loan using the annuity method, meaning that interest for investors is recalculated each month based on the remaining unpaid portion of the investment. At the beginning of the term, a larger portion of the monthly payment goes toward interest and a smaller portion toward the principal. As the term progresses, the principal portion increases while the interest portion decreases.

Example: A 100 € loan with 12% annual interest over 24 months. The monthly payment is 4.71 € (4.71 × 24 = 113.04 €). In the first month, interest is calculated on the full amount: 100 × 1 / 100 = 1 €, so of the 4.71 € payment, 3.71 € goes toward the principal and €1 toward interest. In the second month, the outstanding balance is 96.29 € (100 – 3.71), so interest is €0.96 (96.29 × 1 / 100), and 3.75 € of the monthly payment goes toward the principal (4.71 – 0.96 = 3.75). Each month, as the outstanding loan decreases, the principal portion increases and the interest portion decreases.

What amount can I invest?

You can invest between 10 € and 500 € in a single consumer loan, and between 100 € and 1000 € in a single mortgage loan. For crowdfunding (business) loans, the minimum investment is 10 €, with no maximum investment limit. There is also no limit to the number of consumer, mortgage, or business loans you can invest in.

Please note that if an investor has already invested the maximum allowed amount in a single loan, they will not be able to invest in other loans issued by the same borrower.

We recommend diversifying your investments across as many loans as possible. This helps to spread the risk and reduce potential losses in case a borrower fails to meet their obligations.

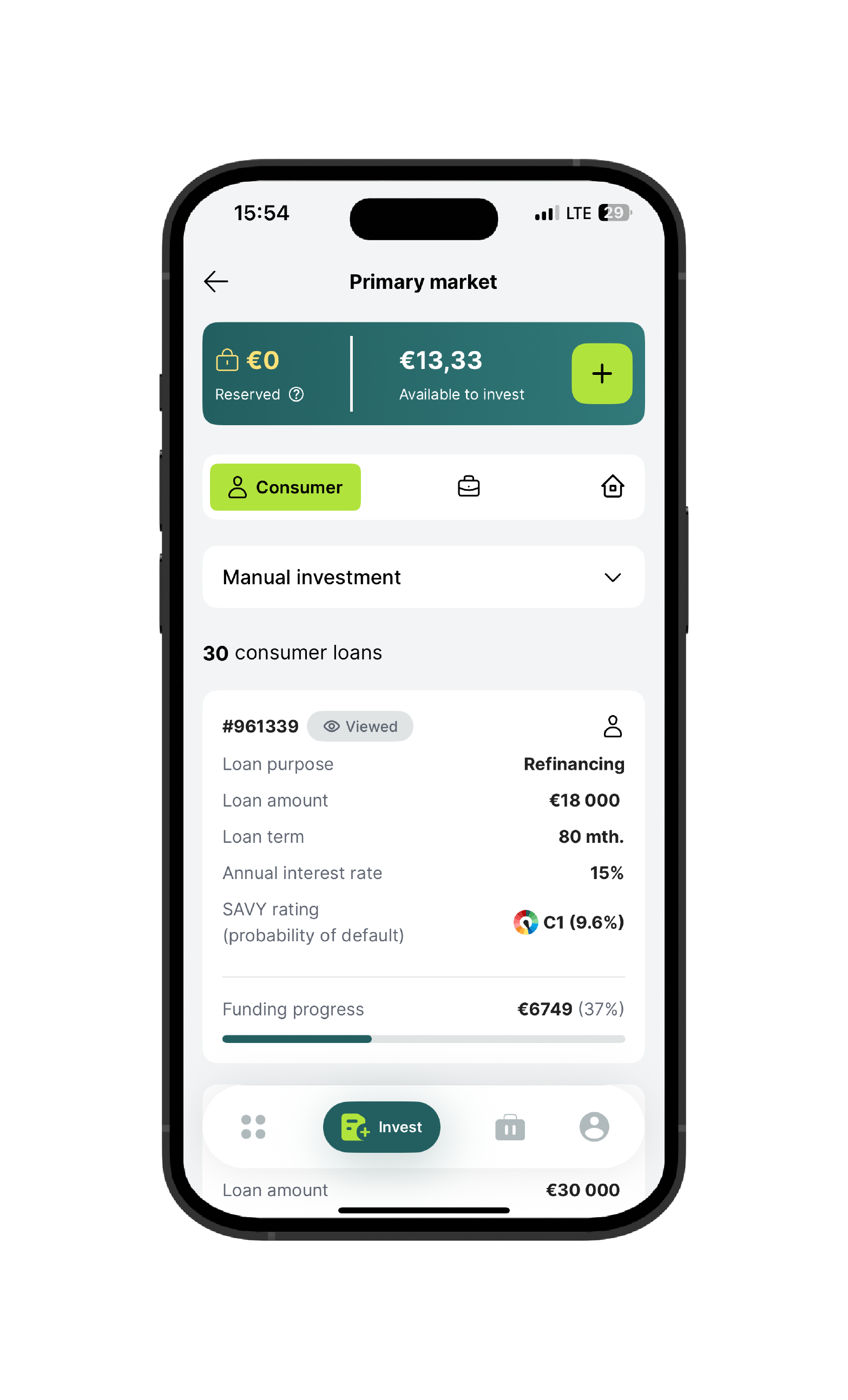

How to choose which loan to invest in?

In the loan list, you will find important information about the loan and its borrower. First, pay attention to the loan’s annual interest rate, SAVY credit rating, loan term, and purpose. If it is a consumer loan, it is important to assess the default risk assigned to each credit rating. When investing in loans to individuals, you can also see the borrower’s age, gender, education, work experience, previously settled registered debts (if any), place of residence, and information about any real estate owned.

Consumer loans do not have collateral, but if you invest in a mortgage loan, you will see information about the pledged property and the loan-to-value (LTV) ratio.

If it is a business loan, the company name, legal form, business description, financial status, guarantees, pledged assets, and other relevant information are provided. Each loan also shows the progress of its funding.

How does loan repayment work?

Once the borrower makes a payment, the funds are distributed to investors according to the investment queue order. If the received funds are insufficient to cover the entire payment, the portion of investments and interest allocated to investors is proportional to the size of their investments. If the funds are not enough to cover the first investment in the queue, a smaller investment next in line is covered. When monetary funds are received from a borrower who was late on payments, late fees owed to investors are deducted first, followed by the current month’s installment.

How long does it take to finance a loan and transfer it to the borrower?

The more attractive a loan is to investors—whether it’s a consumer, housing, or crowdfunding (business) loan—the faster it gets funded. Depending on the amount and the annual interest rate, funding can take anywhere from a few minutes to 7 days. The vast majority of attractive loans are funded automatically, so we recommend setting up automatic investment profiles to avoid missing out on opportunities to invest in preferred short-term loans with high annual interest rates. Once funded, the loan amount is transferred to the borrower; however, investments may be returned if the borrower rejects the loan or no longer meets the lending criteria due to changed circumstances, such as job loss or exceeding the allowable income-to-obligation ratio because of new credits.

Can I cancel my investment if the loan has not yet been transferred to the borrower?

Investments in consumer and housing loans cannot be canceled, so please invest responsibly. Investments in business loans can be canceled within 4 calendar days from the moment of investment. You can do this in the SAVY self-service section under “My Portfolio” → “Reserved.” By clicking the “View” button next to the desired loan, you will see the option to cancel the investment.

What amount is shown in the SAVY account balance?

The balance shown in SAVY corresponds to the funds available in your personal “Paysera” account.

How much does investing cost on the SAVY platform?

The first 6 months of investing are free. After that, a 1 €/month investor service fee applies if your investment portfolio value is at least 0.01 €. To avoid double taxation, this fee is not applied to legal entities, since a business account can only be created by having a personal account.

Can I pause investing? What should I do?

Investors can suspend their account at any time – in this case, the servicing fee will no longer be charged. Account information will remain accessible, and returns from active investments will continue to be transferred to the “Paysera” account linked to the profile. You will also be able to sell your investments on the secondary market — at a premium, discount, or at cost — but your ability to invest in the primary and secondary markets will be limited. To suspend your account, please write to investuoju@savy.lt.

Can I start investing again if my account was suspended?

You can start investing at any time — log in to your account and re-approve the Portal’s Terms of Use agreement. Your account will be activated, and you will be able to invest again in both the primary and secondary markets, securing a source of passive income.

How can I withdraw money from SAVY?

You can transfer funds from your SAVY-linked “Paysera” account to another of your bank accounts at any time. No additional fees are charged for withdrawing money from “Paysera.”

How to withdraw from SAVY?

If you decide to stop investing with SAVY, you can withdraw your invested funds in two ways: by selling investments on the secondary market (at a discount, premium, or at cost) or by waiting for borrowers to repay loans according to the schedule — the repaid amounts will be transferred to your “Paysera” account. If you have activated automatic investment profiles, we recommend disabling them to prevent funds from being reinvested.

To close your investor account on the SAVY platform, please write to investuoju@savy.lt. Depending on the amount of investments you hold, SAVY will take the necessary actions, such as disconnecting your “Paysera” account from the profile. This will render your investor account inactive, and no servicing fees will be applied.

What happens to investments in the event of the investor’s death?

In the event of the investor’s death, the funds held in the “Paysera” account are inherited according to the law or a will. However, the investor’s heirs may be unaware of the existing SAVY account, as such information is not reflected in public registers. To ensure that heirs can inherit not only the investments returned to the investor’s personal “Paysera” account but also future incoming investments, the investor should proactively inform their close relatives about having an active SAVY investment account.

How is SAVY’s peer-to-peer lending activity regulated?

SAVY is a peer-to-peer lending platform operator, operating under the Republic of Lithuania’s Law on Credit Related to Real Estate and the Republic of Lithuania’s Consumer Credit Law. Its activities are supervised by the Bank of Lithuania.

How is SAVY’s crowdfunding activity regulated?

SAVY is a licensed crowdfunding service provider supervised by the Bank of Lithuania. SAVY operates in accordance with the European Parliament and Council Regulation (EU) 2020/1503 on European crowdfunding service providers for business and other applicable laws. You can view the issued license here.

How is the interest earned on the SAVY platform taxed?

For Lithuanian residents, interest earned from loans is classified as Class B income, which is currently taxed at 15% personal income tax. However, from 2026, those not using the investment account regime may be subject to a 20% tax rate or higher, depending on the income earned. Profit from secondary trading of claim rights is also classified as Class B income and is taxed at 15% personal income tax. Bonuses are classified as Class A income, with the income tax remaining the same—15%. For tax-related questions, we recommend contacting the State Tax Inspectorate (VMI).

How to calculate the payable amount?

SAVY automatically calculates the interest and other investment-related income received by investors during the year and submits this data to the State Tax Inspectorate (VMI). This information is reflected in the preliminary income tax declaration prepared by VMI, accessible through the Electronic Declaration System (EDS). Based on this data, investors are required to submit an annual income tax declaration (form GPM308) for the previous year by May 2nd each year. Investors are notified by email once the data is available in the preliminary declaration.

Are income tax reliefs applied?

Currently, you can choose one of two tax relief options.

500 € interest allowance: For Lithuanian citizens (residency does not matter) receiving interest from peer-to-peer lending and crowdfunding platforms, a 500 € allowance applies, so income tax is paid only on the amount exceeding 500 €.

Investment account (IS) allowance: From 2025, the investment account (IS) regulation came into effect. This new system allows you not only to defer income tax payments while funds are reinvested but also to include incurred investment expenses in reducing the taxable profit.

Which tax relief option should I choose?

It is important to understand the differences between the 500 € tax-free allowance and the Investment Account (IS) regime. Choosing the 500 € tax-free allowance means you will pay personal income tax (PIT) only on the amount exceeding 500 €. In contrast, under the IS regime, profit is taxed on the entire capital gain, but only when you withdraw it.

For example, if at the end of the declared year your portfolio on the SAVY platform amounts to 10,000 € and you earned 1,000 € in interest during the year, the differences would be as follows:

- Choosing the 500 € allowance, the payable PIT would be 75 € (15% of 500 €).

- Choosing the IS regime and deciding to withdraw the 1,000 € profit at some point in the future, the payable PIT would be 150 € (assuming the PIT rate remains unchanged). In this case, the profit is calculated from the capital gain minus investment-related expenses.

Each investor’s situation is individual and depends on portfolio size, the amount of interest earned, and when you plan to withdraw the profit. However, we recommend using the IS regime only for larger investors whose annual earnings are at least 1,000 €.

Can a “Paysera” account linked with SAVY be declared as an investment account?

Yes, an investment account can be considered an account opened at a financial institution in Lithuania or another European Economic Area (EEA) country, such as “Paysera.” One individual can have more than one investment account, and there is no limit on the total amount invested through these accounts. When withdrawing funds, the income and losses from all investment accounts are combined, and the profit is taxed.

Important: If you decide to declare your “Paysera” account linked with SAVY as an investment account, no non-investment-related transactions should be conducted on it. For example, the investment account should not be used for salary payments, receiving other income, or daily expenses.

We recommend SAVY investors declare their currently used “Paysera” account as an investment account and open a separate account for other purposes (e.g., household expenses).

Is the income taxation different for Lithuanian and foreign residents?

For Foreign Individuals (Non-Residents of Lithuania)

According to applicable laws, SAVY is responsible for collecting the personal income tax (PIT) from investors who are not permanent residents of the Republic of Lithuania. The PIT rate is 15% and is automatically deducted from the earned interest when a loan payment is received. Additionally, there is currently a €500 tax exemption, but this exemption can only be applied at the end of the year when submitting the annual income tax declaration.

If you are not a permanent resident of the Republic of Lithuania and live in a country that has signed a Double Taxation Avoidance Agreement (DTAA) with Lithuania, you can reduce the applicable income tax rate. Please contact us by email at investuoju@savy.lt, and we will provide all necessary information on how to reduce the applicable PIT rate.

For Foreign Legal Entities (Foreign Companies)

Whether interest is taxable depends on the country in which your company is registered. If the country is within the European Economic Area (EEA) or has signed a Double Taxation Avoidance Agreement (DTAA) with the Republic of Lithuania, profit tax is not withheld. To benefit from the profit tax exemption, you need to provide us with supporting documents via email at investuoju@savy.lt.

Such documents could be a certificate of residence issued by the foreign tax authority (DAS-1 form) titled “Request of a Foreign State Resident to Reduce Withholding Tax,” or a form related to the application of international double taxation avoidance agreements (FR0021) filled out on the State Tax Inspectorate (VMI) website. If the countries are not on any of these lists, a 10% profit tax applies.

What is automatic investing?

Automatic investing allows investors to deploy funds based on pre-set criteria and save time. All investors with active automatic investment profiles participate in the investment queue. When a loan matches the investor’s criteria, the system automatically invests in it, and the investor, with all their profiles, moves to the end of the queue to wait for the next investment cycle.

It is important to know that even if a loan application meets your automatic investment criteria, the investment may not be made if your turn in the queue has not yet come. If you notice that your automatic profile is investing too little, we recommend reviewing the profile settings – the more flexible the criteria, the more frequently it will invest.

How to create an automatic investment profile?

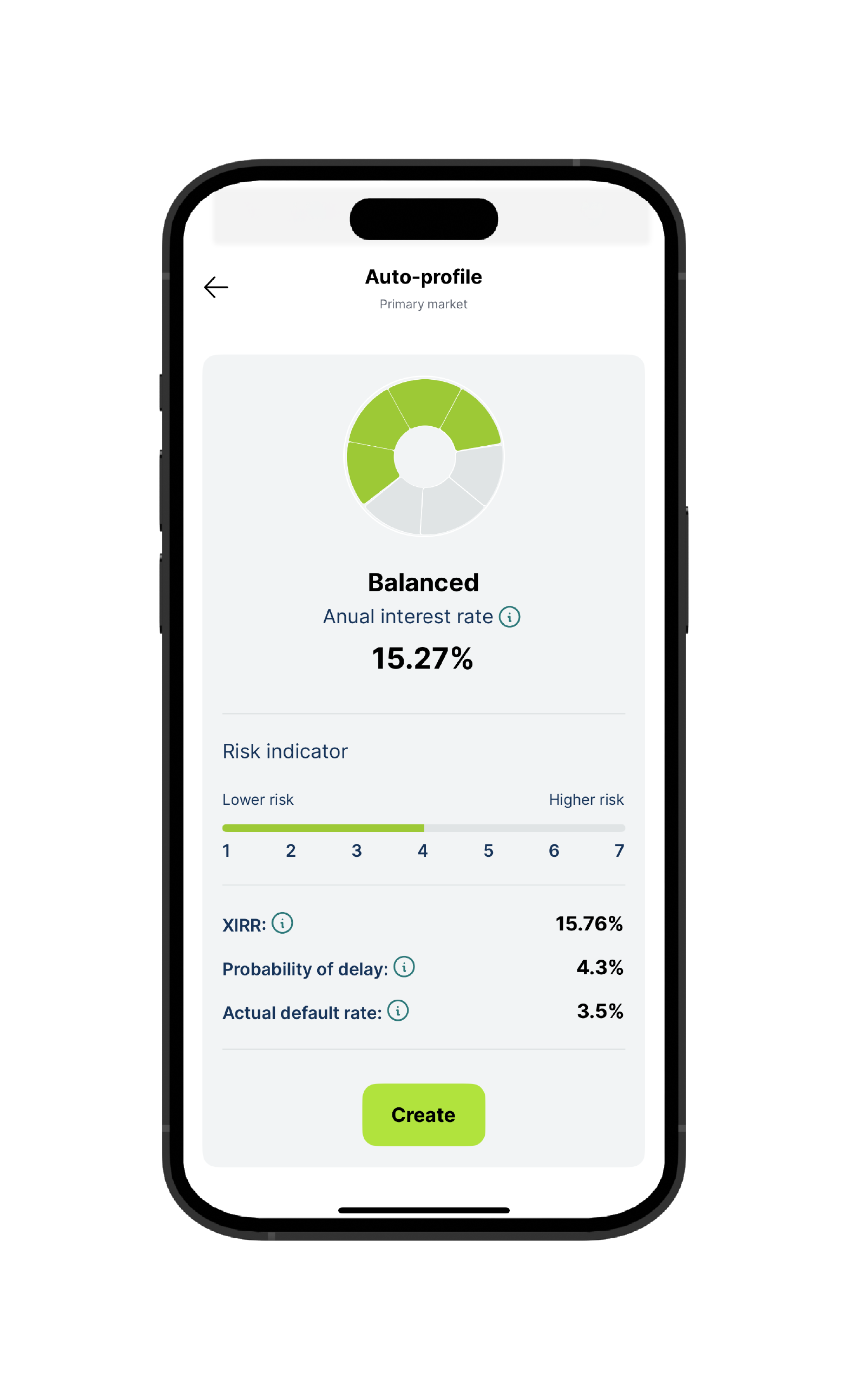

When investing in consumer loans, it is most convenient to choose an automated investment strategy. You can compare them based on four key criteria: average weighted historical interest rate, actual return (XIRR), predicted delay probability, and actual default rate. Four strategies are offered: Cautious, Conservative, Balanced, and Aggressive. You also have the option to create a custom investment profile for both consumer and business loans in the primary and secondary markets. In total, you can have up to 20 different profiles.

How does automatic investing work?

All investors with automatic investment profiles invest in loans according to the investors’ queue. That is, after investing in an application that meets all the investor’s specified criteria, the investor moves to the end of the queue of investors who invest automatically and waits for their turn.

Even if a loan matches the selected automatic investment criteria, not all investors whose criteria it meets may invest in it. This happens when a specific investor’s turn in the queue has not yet come.

How to manage investment risk? What is the Investors' fund?

The Investors’ fund is an additional risk management tool designed for those investing in consumer loans. If a consumer loan borrower fails to meet their obligations for 90 consecutive days, the Investor Fund compensates the investor for the unpaid portion of the investment and the interest accrued during that period.

The Investors’ fund is financed from the interest paid by borrowers. This means that by using the fund, the investor receives a lower interest rate but can reduce default risk.

The Investors’ fund compensates as long as there are sufficient funds in the fund. If borrower defaults increase, the fund may become depleted, and compensation would be postponed until the fund is replenished. Once there are enough funds, compensations are paid in order. No late fees or other charges are paid to the investor for the waiting period. Compensation is automatic – the investor does not need to submit requests, fill out forms, or provide documents.

The Investors’ fund protection applies only to investments in consumer loans. Investments with Investors’ fund protection on the SAVY platform are marked with a shield. More detailed information about the Investors’ fund can be found here.

What happens when a borrower is late with payments? Will I receive late fees?

When a borrower is late with a payment, late fees are automatically applied. For consumer and home loans, the late fee is 0.05% per day on the overdue amount (not the full installment). For business loans, a 0.2% late fee is charged along with penalty interest (at the same annual interest rate as the loan) for each overdue day on the overdue amount.

Late fees begin to accrue two days after the payment due date, allowing time for the payment to be processed in case of interbank delays or other technical issues (e.g., if the payment is due on July 5, late fees will start accruing from July 7).

Late fees are rounded to two decimal places.

Example: A consumer loan monthly installment is 50 €, the payment is 13 days late, so the late fee is:

50 × 0.05 / 100 × 13 = 0.325. Rounded up, it becomes €0.33.

Important: All late fees and penalty interest are split equally – 50% goes to the investor, and 50% to the platform to cover administrative debt recovery costs.

How does the recovery process work?

Consumer Loans

If the borrower fails to meet their obligations, late payment interest is charged for each overdue day. After approximately 40 days, the debt is transferred to pre-judicial recovery and registered in the “Creditinfo” or “Scorify” databases to prevent the client from taking on new obligations.

SAVY may terminate the agreement after 6–7 missed payments or earlier if the client is uncooperative. Once the agreement is terminated, late payment interest is no longer calculated. More information about the recovery process can be found here.

Crowdfunding (Business) Loans

If the borrower fails to meet their obligations, late payment interest and penalty interest are charged for each overdue day. The agreement is terminated after 3 missed payments, unless the borrower is cooperative and an agreement is reached. More information about the recovery process can be found here.

How are statutory interest (default interest awarded by the court) calculated?

Statutory interest is awarded by the court. By default, individuals are charged 5% annual interest on the adjudged amount, and legal entities – 6%.

How to Deactivate Your Investor Account

If you wish to deactivate your SAVY investor account, please first ensure that you have no active investments and that all funds have been returned to your account.

To submit a request for account deactivation, please contact us:

- by email: labas@savy.lt, or

- by registered mail: Latvių g. 36A, LT-08113 Vilnius, Lithuania

When submitting a free-form request or using the recommended SAVY form, please provide the email address associated with your account and any other information necessary to verify your identity.

Your account will be deactivated no later than 30 calendar days from the receipt of your request. We will notify you of the account deactivation through the same channel you used to submit your request – either email or

registered mail. Once deactivated, your account will be closed and will no longer be visible among your other accounts (if any).

Important Information

- Completion of investments: Before submitting a deactivation request, ensure that all your investment transactions are completed. Once your account is deactivated and your Paysera wallet is disconnected, you will no longer be able to receive any refunded funds, and you will lose access to your investment history and related information.

- Right to erasure (“Right to be forgotten”): You have the right to request the deletion of your personal data under Article 17 of the GDPR, except where we are legally required to retain certain information (e.g., identity verification data, Know Your Customer (KYC) information, financial or accounting records).

- Potential consequences: Exercising your right to erasure may limit your ability to submit new complaints or receive notifications regarding the status or outcome of ongoing complaints.

What Happens to Your Personal Data?

- Legal obligations and data retention: Before deactivating your account, we will retain personal data related to identity verification, financial transactions, and accounting activities for as long as required by applicable law and in accordance with our Privacy Policy.

- Data deletion: Upon deactivation, your contact information, login credentials, and linked Paysera account will be deleted.

- Account restoration: Deactivated accounts cannot be restored.